The fastest way to make $10k in real estate is by saving it in taxes

No 7-day challenge, no 4-week crash course, just simple and to the point tax strategies anyone can understand with real life examples myself and clients have executed to save tons on taxes and grow our portfolios

If you are…

A real estate investor with 1 to 10 doors looking to maximize your tax savings without having to sort through all the bad advice found online - this is for you!

These strategies have helped countless real estate investors significantly reduce their tax bills allowing for more money to be reinvested on the path to financial freedom.

Questioning your current tax preparer or want to DIY it without having to spend thousands on 1-1 tax planning? This course provides an affordable option for those just getting started.

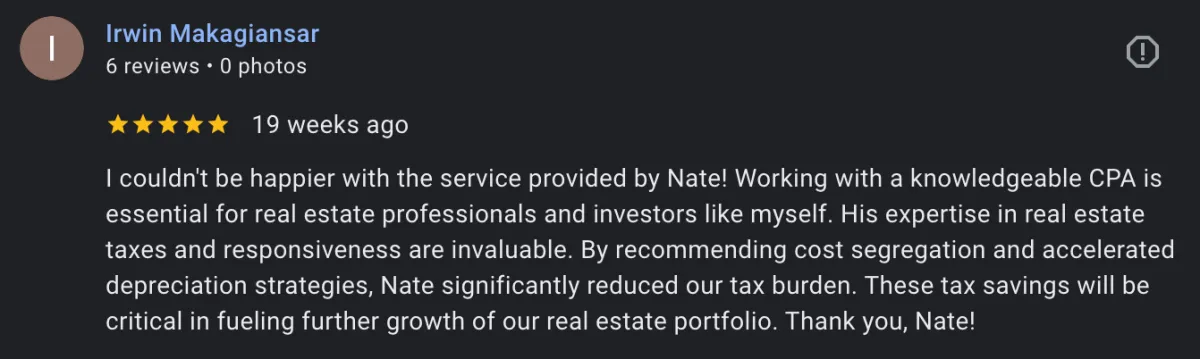

Irwin saved $30k last year by implementing these strategies!

Expensive 1 on 1 tax planning isn’t for everyone

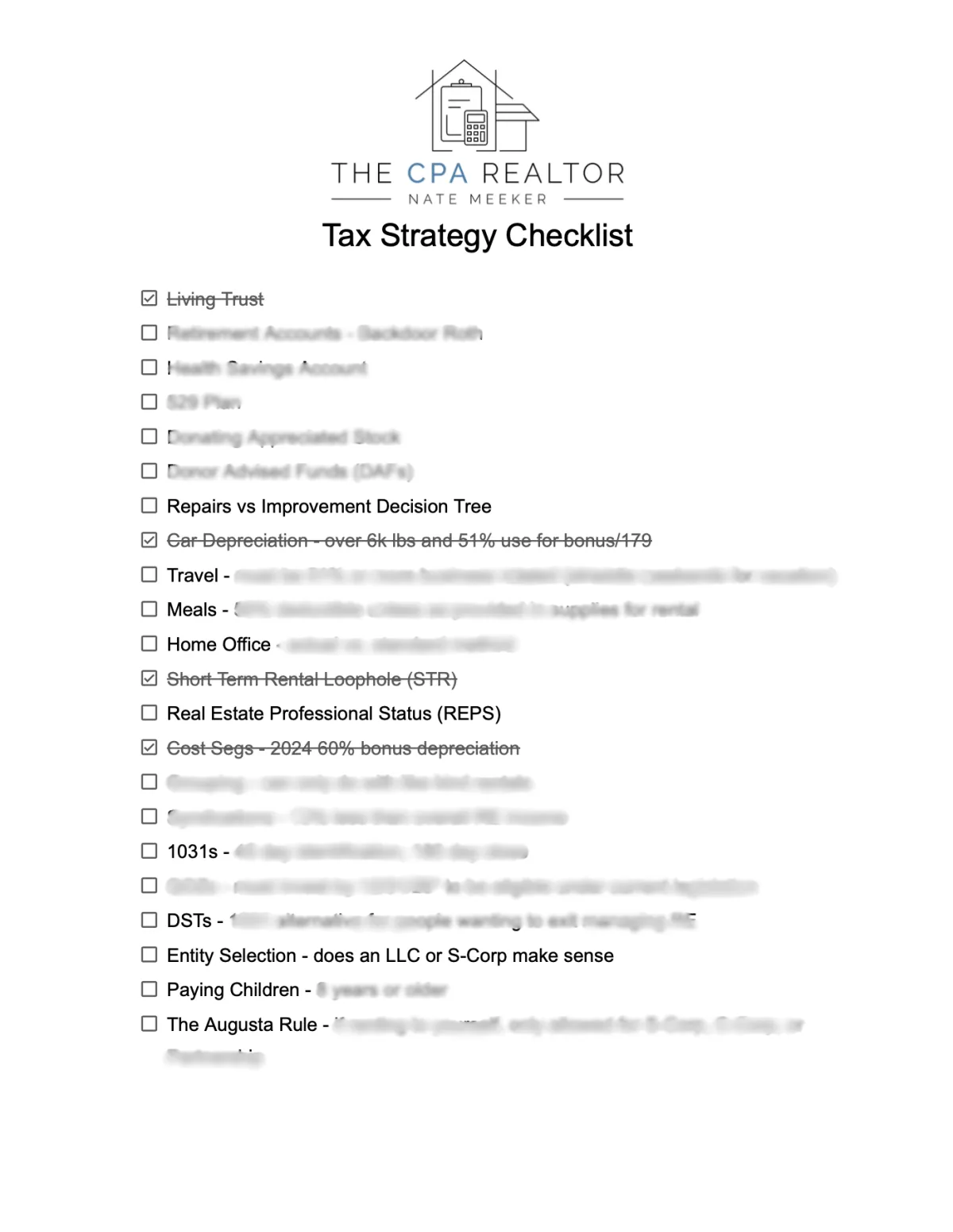

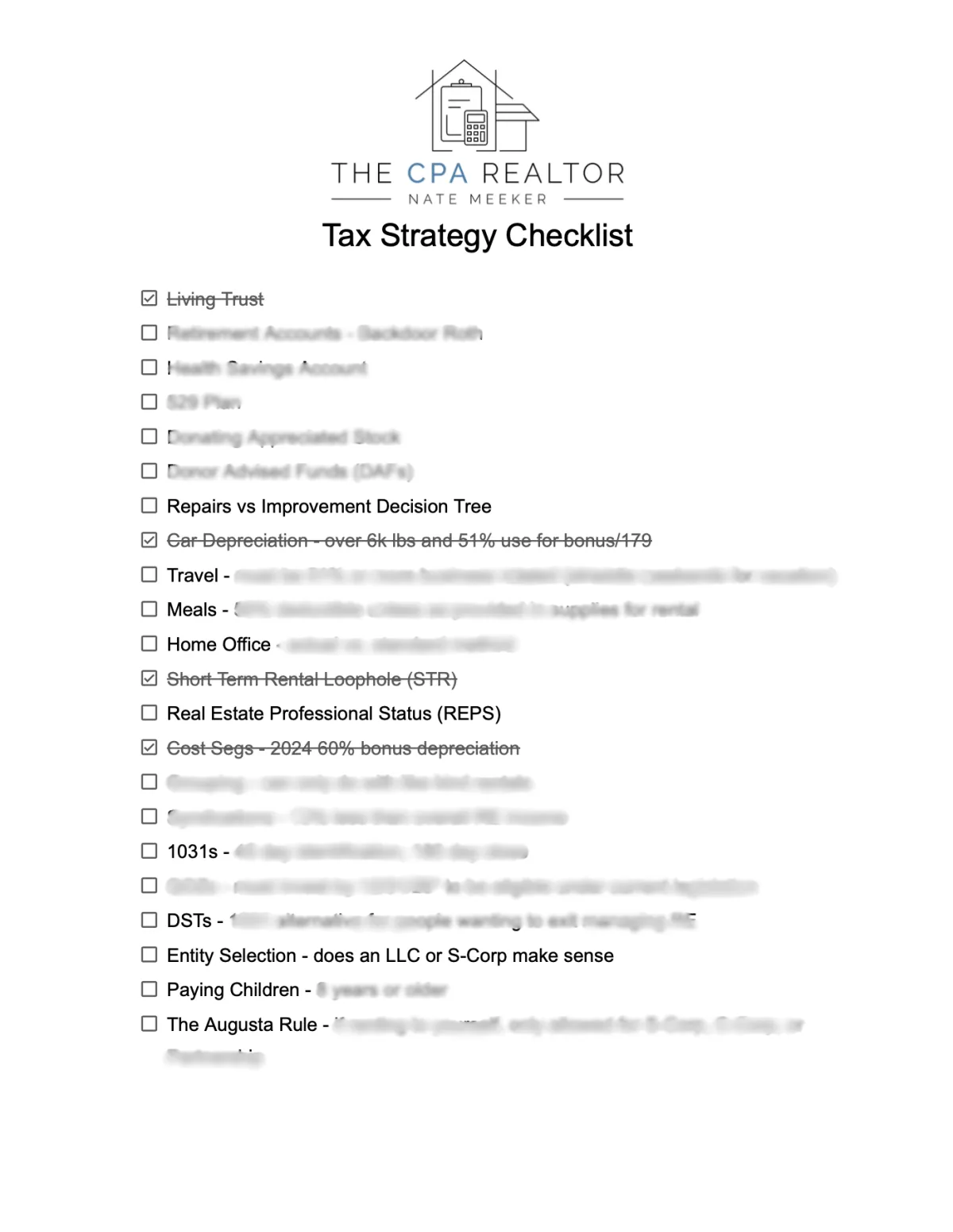

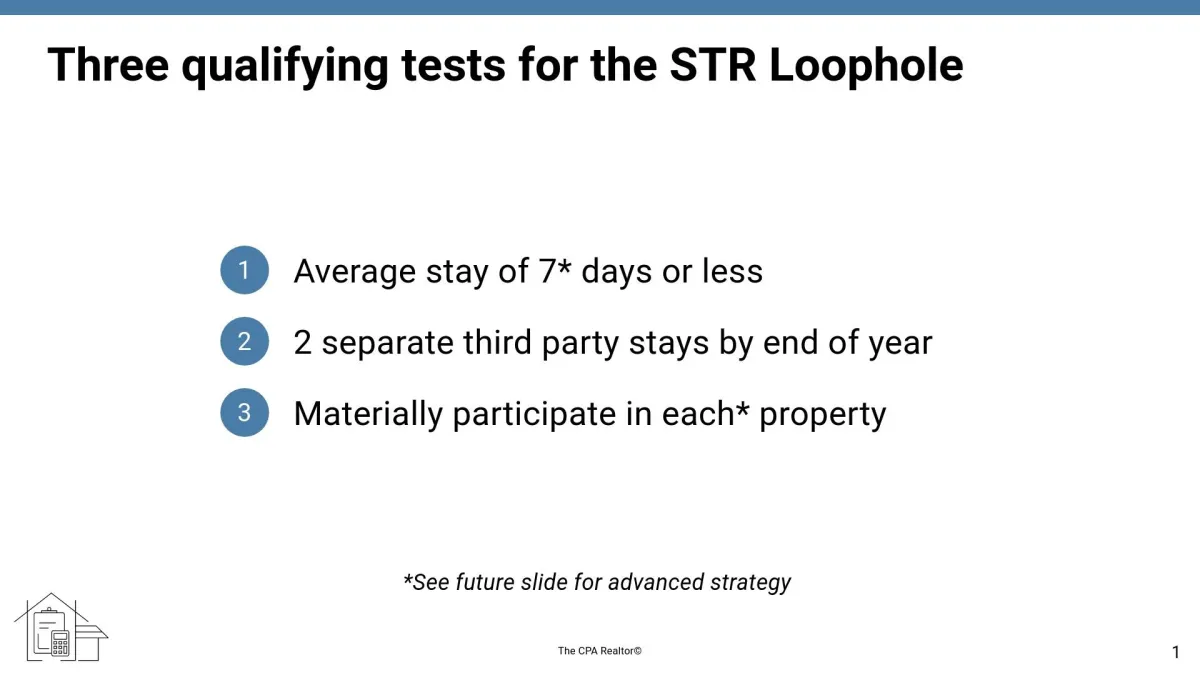

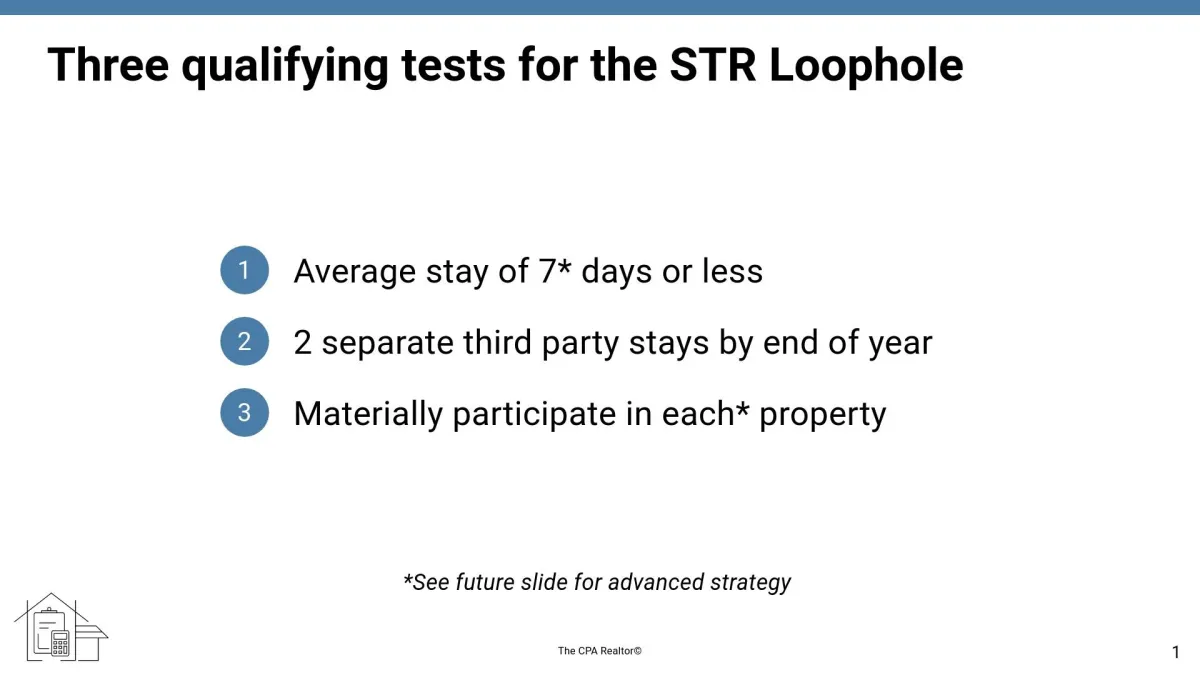

10+ videos and resources designed to save you time wondering if flashy social media strategies like Cost Segregations, the Short Term Rental Loophole, paying children, or the Augusta rule can really save you money.

Valued at over $1,000, this masterclass of tax strategies will save you money for years to come for only $147.

Expensive 1 on 1 tax planning isn’t for everyone.

10+ videos and resources designed to save you time wondering if flashy social media strategies like Cost Segregations, the Short Term Rental Loophole, paying children, or the Augusta rule can really save you money.

Valued at over $1,000, this masterclass of tax strategies will save you money for years to come for only $147.

Implement aggressive strategies with confidence and understanding

Sure, you can find similar content online for free, but why not save time and money by doing it right the first time with some extra guidance?

Trust me, I’ve seen it cost investors ten times more in cleanup accounting and legal fees or even worse yet IRS taxes and penalties for those who tried to rely on free help.

Many students end up amending tax returns after purchasing a course once they’ve learned there are strategies they can apply retroactively to save money instantly!

course details

Learn how rental income and expenses impact your personal amount of tax

Define key terms and forms to plan better

Sch E, 8582, 4562- Grasp the passive activity loss rules and why your losses might be limited

Know what operating expenses to keep track of- Repairs vs. maintenance

know what is an expense and what needs to be depreciated

Understand how depreciation works

Actionable tips for any taxpayer

Gain a clear understanding of the tax return structure to make better decisions

Specific strategies to increase itemized deductions

Optimize your retirement plans + Tax efficient education and health savings plans

Private family foundations simplified

Understand tax payments, penalties, and interest for planning purposes

Leverage the tax code to keep more of your hard earned money

Discover why depreciating your vehicle may not be the smartest move

Strategies to deduct “vacation” costs when traveling for work

Details of the home office deduction no one mentions online

My honest opinion about record keeping and audits

Offset your W2 income with confidence after understanding they key requirements

Material participation simplified and easy to understand examples

Utilize property managers while still receiving all the tax benefits

Common questions answered like Sch C vs Sch E and if you need an LLC

Advanced strategies like converting to a long term rental discussed

Utilize a spouses real estate profession to pay almost zero taxes

Interpret what this designation means, how to qualify, and what strategies are available

How some W2 employees might qualify

Advanced strategies like combining rental activities, leveraging cost segregations, and investing in syndications simplified

Get the most depreciation by understanding building vs. land values

Example of how to estimate your tax benefits

Understand the pros and cons no one talks about online

How to utilize this tool outside of STR or REPS applications

Decide what tax year this is best to execute

Depreciation recapture simplified

My honest opinion on minimizing audit risk

Learn how to trade up the real estate value ladder without paying any tax

Complex terms and timelines simplified ensuring a smooth transaction

Consider potential drawbacks no one talks about online

Strategies the wealthy use to transfer properties tax efficiently

Examples, common questions, and alternative strategies discussed

Decide what legal entity is best for you now and as you grow

Understand that anyone with real estate needs a living trust

Strategies to leverage the different benefits of LLCs, S-Corps, and C-Corps

How to form it, where to register it, and other forms of legal protection discussed

My honest opinion on if and when an LLC is even necessary

How to pay your kids and rent your home enabling tax free money

Details on qualifying factors and estimates to determine if it’s worth it

Simplified rules so you feel confident executing advanced strategies

How to defer any capital gains and potentially see tax free growth

Starting your own fund or invest with others discussed

Complex rules simplified so you can take advantage of this little known strategy

Valued at over $1,000

this masterclass of tax strategies

will save you money for years to come

for only $147.

More Reviews

Nate really understands short term rental investing and related tax rules. Not only is he knowledgeable, he is prompt and detailed in his advice. As an example, he provided a detailed response, referencing specific sections of the IRS code, to my questions regarding the cost segregation and possible negative AMT consequence. For a detail oriented person like me, I appreciated his detailed answer.

~ TAE NAM

Found Nate on Bigger Pockets. We were looking for a CPA who specializes in investment real estate. We had good conversations which enabled us to find additional write offs to off set our income and ultimately reduce our taxes. Nate is a pleasure to work with and his portal is easy to navigate and use. What a relief to not have to fill out paper forms!

~ WALT BLUM

We had the pleasure of working with Nate from The CPA Realtor for our 2023 tax return and we couldn't be happier with the level of service he provided. Nate was knowledgeable with STR laws and monthly rentals, professional, and always responsive to our questions and concerns. We have no doubt that we will continue to rely on his expertise in the future and would highly recommend his services to anyone in need of a reliable and trustworthy tax advisor.

~ TANYA MALKON

FAQS

Do you offer guarantees or cancelations?

Sorry, no bs “tax-free” living guarantee sold here. These are actionable insights worth every penny.

What is the time commitment and do I need to be a genius?

You are paying for several years of knowledge and expertise simplified into short courses a high school student could understand and complete in one weekend. Of course, feel free to take it at your own pace.

I personally believe in providing value per second versus stringing you along a multi-week 40 hour course.

What if I have questions?

Courses do not have access to live Q&A.

Stay tuned for an offer to join our community to get access to live calls and a network of other investors.

About Me

In 2017, I discovered the Bigger Pockets Podcast and started my long-distance investing journey, purchasing a single family rental in Florida sight unseen. Since then, I've completed several BRRRRs, flips, and creative finance deals.

Gaining tax experience at one of the “Big 4” global accounting firms and eventually moving on to manage a small regional firm, I continued to expand my rental portfolio. As I networked with other investors it became clear that most general tax preparers were not entirely aware of, nor educating their clients on the intricacies of real estate tax strategies.

This ultimately led to opening my own firm where we specialize in real estate. Based in Southern California serving clients nationwide, 90% of our clients own 1-10 properties and implement suggested strategies annually like the STR Loophole, REPS, Bonus Depreciation, and 1031s to scale their portfolio.

The strategies we suggest, we implement ourselves in our own real estate portfolios.

listen to a fellow investor & long time client

share his experience in working with The CPA Realtor

P.S. prices will increase...

lock in your lifetime price today!

Copyright © 2024, The CPA Realtor - All Rights Reserved